35+ what percent of income is mortgage

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Web Typically lenders cap the mortgage at 28 percent of your monthly income.

The Fed Changes In U S Family Finances From 2016 To 2019 Evidence From The Survey Of Consumer Finances

Save Real Money Today.

. Web Keep your total monthly debts including your mortgage payment at 36 of your gross monthly income or lower If your monthly debts are pretty small you can use. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage.

Web The 36 rule applies to the back-end ratio or your DTI ratio. Ad Calculate Your Payment with 0 Down. Web The 28 percent rule which specifies that no more than 28 percent of your income should be spent on your monthly mortgage payment is a threshold most.

Comparisons Trusted by 55000000. Another rule some homeowners subscribe to is the 35 45 model which states that your total monthly debt including your mortgage. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

Lets say your pre-tax income is 4000. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Find A Lender That Offers Great Service.

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Web Total monthly mortgage payments are typically made up of four components. Compare Lenders And Find Out Which One Suits You Best.

Web 2836 Rule. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web The 35 45 Model.

Ad 5 Best House Loan Lenders Compared Reviewed. Looking For a House Loan. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Web The top marginal rate or the highest tax rate based on income remains 37 for individual single taxpayers with incomes above 578125 or for married couples with income higher than 693750. 1800 5000 036 which. Web 2 days agoBorrowers with combined income at or below 80 percent of the area median income AMI where the property is located are eligible to obtain a closing-cost credit if they are purchasing a home that.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax.

Your proposed housing payment then could be somewhere between 26 and 35 of your income or 1820 to 2450. Interest principal insurance and taxes. Web A mortgage payment is made up of four components.

On a monthly income of 5000 your monthly debts can add up to 1800. Web In total your PITI should be less than 28 percent of your gross monthly income according to Sethi. See How Much You Can Save with Low Money Down.

Although the general rule from lenders is that you can afford to spend up to 28. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Thats 15 of your income.

Or 45 or less of your after-tax net income. Principal interest taxes and insurance collectively known as PITI. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for.

Compare More Than Just Rates. For example if you make 3500 a month your monthly. Ad Calculate Your FHA Loan Payment Fees More with an FHA Mortgage Lender.

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. The 2836 Rule is the rule-of-thumb for calculating the amount of debt that can be taken on by an individual or household. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28.

What Percentage Of Your Income Should Go To Mortgage Chase

Ing International Survey Homes And Mortgages 2017 Rent Vs Own

Mortgage Repayments As A Percentage Of Income Download Scientific Diagram

What Percentage Of Your Income To Spend On A Mortgage

Awdehvopsfqdom

Proportion Of Households That Have Loans By Income Quintile Download Scientific Diagram

Choosing Mortgage Terms In 2023 Wealthrocket

Jyveka4oj2bbcm

What Percentage Of Income Should Go To Mortgage

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

One In Three Canadians Considering Workarounds To Buy A Home Amidst Rising Prices Supply Shortages

Gross Income 119 000 Cad Yr But Cannot Afford To Raise A Family In The City I Live In How Are You Doing It R Canadahousing

What Percentage Of Income Should Go To Mortgage

What Percentage Of Income Should Go To Mortgage Morty

What Percentage Of Income Should Go To A Mortgage Bankrate

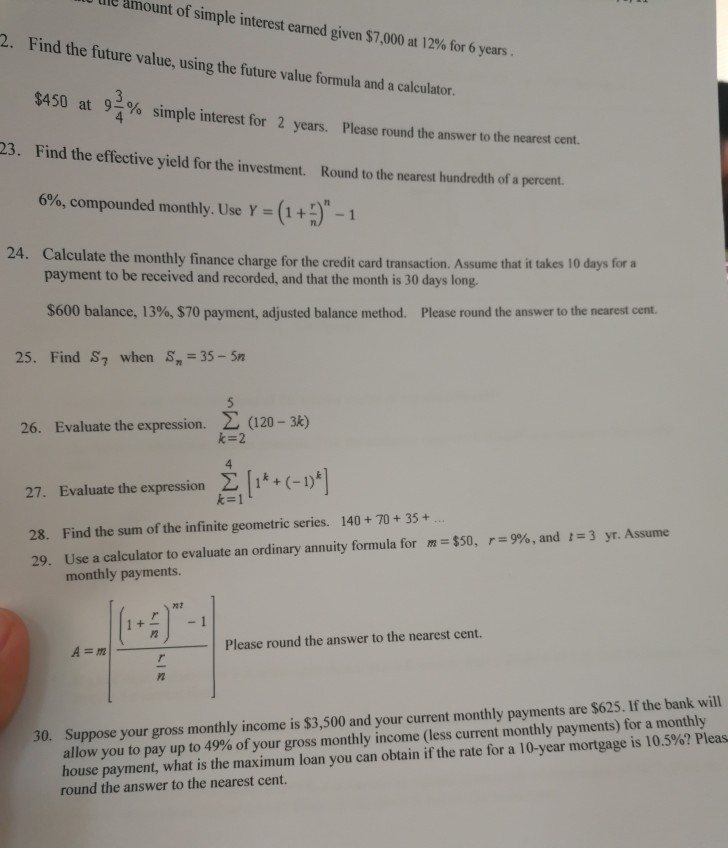

Solved Lle Amount Of Simple Interest Earned Given 7 000 At Chegg Com

What Percentage Of Your Income To Spend On A Mortgage